Compounding: The Power of Saving Now

You know how important it is to save, but did you know it’s also critical to start saving now? Starting to save today, and not in two days, two weeks or two months can make a huge difference. Nichole Coyle, CERTIFIED FINANCIAL PLANNER™, talks about compound interest, its benefits, and why you should start saving now.

What is Interest?

Interest, defined broadly, is the profit that accrues in a savings or investment account. There are two main types of interest: simple and compound.

Simple interest is a quick and easy method of calculating the interest charged on a loan. Simple interest is determined by multiplying the daily interest rate by the principal by the number of days that elapse between payments. This type of interest usually applies to automobile loans and other short-term loans.

Simple Interest vs. Compound Interest

Simple interest is based on the original principal amount of a loan or deposit. It is very simple to calculate because of this. On the other hand, compound interest is based on the principal amount and the interest that accumulates on it each period. It’s a bit more complex because of how compound interest is calculated.

Compound interest is the interest on a deposit calculated based on both the initial principal and the accumulated interest from previous periods.

For example:

$100,000 with a compounding interest rate of 5% will yield $105,000 for the first period.

Then interest is earned in the second period on the new balance (not only the principal) of $105,000, and at 5%, that would yield $110,250.

Then, the third yields $115,762.50, and so on.

This type of interest usually applies to savings accounts, money market accounts, mutual funds, and other investments, which have a longer time horizon than simple interest accounts and loans.

Saving Early with Compound Savings

The benefit of saving early and using the power of compounding is that it doesn’t take a lot of money to start. Relatively small amounts invested regularly can make a significant difference in the total size of your savings down the road.

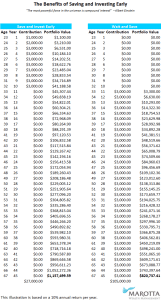

The earlier you start saving, the more time your money has to compound. Regardless of your age, the best time to start saving is today. Putting it off to tomorrow or some other time down the road will only cause you to miss out on the power of compounding. Below is a chart from Marotta showing the benefits of saving early. Both sides show a 10% compounding rate, but as you can see, the difference in waiting is vast!

By starting right away and investing $27,000 over a 10 year time period this option compounds and grows to $1,157,499.59. However, by starting just ten years later and investing $105,000 over 35 years, this option still doesn’t catch up to the first!

Imagine what the growth could look like if you started at age 23 and continuously saved $3,000 per year with compounding at a 10% rate!

Start Saving and Compounding Now!

Young people have many expenses that often take priority over long-term savings. Saving for a home, mortgage payments, student loan payments, starting a family, and so on. However, saving a small amount, yes even $25-50 a paycheck, and setting it aside for your future can have immense growth potential.

Don’t be discouraged if you didn’t start saving in your early 20s, though. You may need to set more aside, but you can still benefit from the power of compound savings. And if you are young, or have loved ones that are young, share this with them and encourage them to prioritize long-term savings.

Contact me today to learn more about saving for your future, compound interest accounts, or other financial matters.

Nichole M. Coyle,

CERTIFIED FINANCIAL PLANNERTM

20333 Emerald Pkwy, Cleveland, OH 44135

216.621.4644 x1607

Securities and advisory services offered through Cetera Advisor Networks LLC, member FINRA/SIPC, a Broker-Dealer, and a Registered Investment Advisor. Cetera is not affiliated with the financial institution where investment services are offered or any other named entity. Investments are: Not FDIC/NCUSIF insured * May lose value * Not financial institution guaranteed * Not a deposit * Not insured by a federal government agency.

Posted In: Guest Blog, Saving