4 Reasons it’s Important for Kids to Learn Financial Literacy

Think childhood is too early to learn financial literacy? Think again! Do you remember learning how to tie your shoe? Do you still tie your shoe the same way? Simple skills learned while young stick and can help them throughout their lives.

A FINRA Investor Education Foundation study found that four in five young adults couldn’t pass a financial literacy quiz. It’s not surprising considering 27 states in the US received a C, D, or F for their financial literacy curriculum, according to data collected by Champlain College’s Center for Financial Literacy.

These statistics show a drastic need for children’s financial literacy programs. But if that’s not enough, here are four reasons your kids should be learning financial literacy today!

1.Money is Everywhere

Even if kids cannot understand advanced money concepts at a young age, they’ll need to learn them eventually. Kids will start to need and use money to buy toys, join activities, or participate in social experiences like attending concerts, games, or visiting amusement parks.

Teaching kids about saving and spending now will help them understand why they can’t always get what they want. Learning to manage money early not only helps create responsibility but can help limit entitlement and understand delayed gratification.

2. Financial Education Helps Kids Grow into Financially Confident Adults

Many adults these days struggle to successfully handle their finances. 50% of Americans don’t have a savings account with at least $400 to cover a financial emergency. Teaching kids now helps form habits that can lead to a better relationship with money as adults.

Life is often unpredictable as an adult so despite preparing for unexpected costs, sometimes a $500 car or house repair appears out of nowhere. If kids actively participate in activities allowing them to save, spend, and give, they learn to have a plan for the future. The earlier these financial habits are started, the more likely kids will take them into adulthood.

3. Knowing How to Manage Money Can Lessen Anxiety

As you may have read, the United States is dealing with a mental health crisis. In 2020, mental-health emergency visits at the hospital increased by 24% for 5 to 11-year-olds. To add to these statistics, about 68% of children from ages 8 to 16 worried over their parent’s finances in 2018, and this can cause mental health issues such as anxiety, depression, or PTSD.

As psychologists learn more about mental health, they unravel that money influences children far more than once thought. And since children can take an adult’s stress and mimic it, it’s no wonder that economic issues can affect them.

Children already have a lot to deal with today, so money should be one less problem. Don’t let your kids stress too much about money by giving them the right tools to face financial problems today.

With 66% of Americans worrying about how to pay for healthcare, it’s imperative to teach kids now before they run into additional stressors as adults.

4. You’ll Make Many Important Financial Decisions When You’re Young

Major decisions, like attending college (and whether to take out loans), buying a car, or getting that first job or apartment, often all happen before the age of 25. Teens who haven’t started to learn about the best ways to manage money but need to make major purchases are at high risk of making poor decisions that can plunge them into debt.

Additionally, organizations, such as payday lenders, often take advantage of teens’ lack of financial education and lack of money. In fact, the PEW Charitable Trust found that most Americans who are using payday loans are 18 to 24 years old.

Teaching kids now to save for a rainy day, and not to spend more than they earn, can stop them from suffering from unwise financial decisions later.

Don’t Delay Teaching Financial Literacy to Children

Delay Teaching Financial Literacy to Children

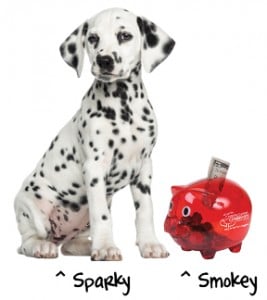

Taking the time to teach children now about money will give them the tools to make smarter choices later in life. At FFCCU, we offer our Sparky’s Kids Club program, which teaches financial literacy through games and activities! Kids learn about credit, savings, compound interest and so much more. Check out Sparky’s Kids Club now and open a youth savings account today.

Posted In: Saving, Sparky's Kids Club