What’s the Best Choice: Paying off a Mortgage or Investing?

Are you wondering if paying off your mortgage early or investing is a better choice in the current economic climate? Nichole Coyle, Certified Financial Planner™, has some answers to help guide your decision.

Why It May Make Sense to Pay off Your Mortgage Early:

1. You have a high-interest rate and refinancing to a lower rate isn’t an option

Your interest rate could be high for several reasons. Maybe your credit score isn’t high enough to qualify for a lower rate or the current rates aren’t any lower (or close enough that it’s not worth the fees to refinance).

2. You have a low-risk tolerance for investing

If watching the market drop 15-20% lately has your stomach in a lurch, and you see this as a time for panic versus opportunity; you may have a low-risk tolerance. There are several factors to consider when determining your risk tolerance. Still, if you have a low-risk tolerance, it may be more comfortable to use extra funds to reduce your debts, like your mortgage, instead of investing.

3. You have a short time horizon for an investment

This goes hand-in-hand with your risk tolerance. For example, if home values are increasing and you plan to sell/buy a new home soon by reducing your mortgage principal, you are increasing the gain you’ll receive from the sale of your home, which can go towards the down payment of a new home or repairs and such. If you were to invest instead, there is a risk that you could lose some of your principal because of the short time horizon and the volatility of the market.

4. You aim to be debt-free

This can be a major goal for many people. Debt carries risk. Debt doesn’t care if you lose your job or you incur major medical bills. Being debt-free can reduce your overall risk, make you feel more secure, and bring you peace of mind.

Why It may Make Sense to Invest Instead:

1. You already have a low-interest rate on your mortgage

Or you can quickly refinance your mortgage to a low-interest rate. A lot of this happened over the past few years when mortgage rates were so low. If you’re only paying 3% interest on your mortgage loan, and you find an opportunity to earn an average of 8-10% on an investment account, you’ll likely see larger gains by going this route.

2. You have a higher risk tolerance

Suppose you see market drops as an opportunity. In that case, you could take advantage of buying low or dollar-cost averaging investments instead of paying down an already low-interest rate mortgage early. If you go this route, you could invest in the market and potentially average 8-10% annually in an investment account instead.

3. You have plenty of time

If you have over five years until retirement, you could contribute extra to your retirement account instead of paying down the mortgage. Maybe you’re saving up to buy a new home in 5-10 years, or you just want to take advantage of compounding interest in an investment account to earn 5-7% more than you’d be paying in interest on your loan.

4. You use debt as leverage

You feel comfortable borrowing at a low-interest rate so that you can free up funds to invest for a higher potential gain.

What’s the Best Choice for You: a Mortgage or Investing?

Paying off a low-interest mortgage is usually more of an emotional decision and provides clarity and stability. However, you do give up potential financial gains you could have by paying loans down more slowly and investing the difference instead.

Conversely, choosing not to pay off your mortgage early and focusing on accumulating assets in investments is a riskier move. But higher risk generally comes with a higher reward.

So, what it boils down to is simply what makes the most sense for you, your family, and your financial situation. Investing rather than paying off your mortgage early makes the most sense if you can take on the risk and feel comfortable doing so. However, if you desire more stability and security and don’t want to take the risk, paying off your mortgage early will likely make the most sense for you.

How Long Should my Mortgage Term be?

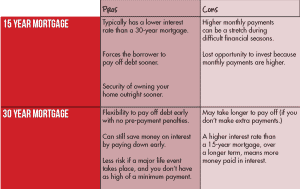

The other big question discussed with mortgages and refinancing is whether to look at a 15 or 30-year mortgage. There are several factors to consider, and there’s no perfect answer. It will again depend on your situation and risk tolerance.

Both mortgage terms have pros and cons; either can be the best decision based on your lifestyle, circumstances, and risk tolerance. A 30 year mortgage is less risky, but comes with the price of more money paid towards interest. A 15-year mortgage comes with more risk but saves you money in the long run.

Choosing the best mortgage term and deciding whether to invest or pay down your mortgage early comes down to your risk tolerance and lifestyle. If you have questions about this or any other financial topics, please don’t hesitate to contact me.

Nichole M. Coyle,

CERTIFIED FINANCIAL PLANNERTM

20333 Emerald Pkwy, Cleveland, OH 44135

216.621.4644 x1607

Securities and advisory services offered through Cetera Advisor Networks LLC, member FINRA/SIPC, a Broker-Dealer, and a Registered Investment Advisor. Cetera is not affiliated with the financial institution where investment services are offered or any other named entity. Investments are: Not FDIC/NCUSIF insured * May lose value * Not financial institution guaranteed * Not a deposit * Not insured by a federal government agency.

Posted In: Guest Blog, Home Buying, Mortgage, Tips For Managing Finances