Want To Tap Into The Equity of Your Home? Here are a Few Differences Between a Loan and a Line of Credit.

When it comes time to tap into your home equity, it may be tough to decide which home equity product is right for you.

Are you looking at tackling a big home renovation project you’ve been putting off? Is your son or daughter going to college, and you want to offset the cost of their tuition? Do you have some high-interest debt to consolidate?

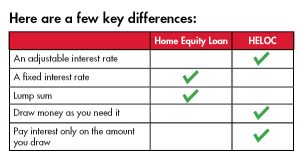

Since both types of loans let you borrow against the equity in your home, it’s good to know the key differences between them and what works best for you and your lifestyle.

What is a home equity loan?

A home equity loan lets you borrow against the equity in your home with a fixed interest rate and a fixed monthly payment. Terms lengths vary, but most often, your loan can be up to 15 years. Having a set term with a home equity loan means you’ll never have to worry about rising interest rates and your monthly payment going up.

When taking out a home equity loan, you can take the money out in a lump sum, which makes it similar to an car loan or a personal loan. It’s a huge plus knowing exactly how much your payment is going to be and not worry about changing interest rates. You’ll know exactly when it will be paid off and can have the satisfaction of crossing it off your monthly budget sheet (Yes, one more bill to take off your list).

What is a home equity line of credit (HELOC)?

A HELOC, or home equity line of credit, is similar to a credit card. You can borrow a varying amount of money as you need it, and pay back the funds slowly. Like credit cards, a HELOC comes with a variable rate, which means the interest rate can go up or down based on market trends.

Typically, a HELOC has a draw period, or a specific timeframe, for you to access your available funds. While you’ll make monthly payments throughout the life of the loan, you’ll only be able to take out funds during the draw period. Once that timeframe is over, you’ll repay any remaining funds you owe, plus interest. For example, with a 15-year HELOC, you may be able to borrow against the equity in your home for up to 7 years. Then you’ll have the remaining eight years to pay off the loan. Depending on how much you owe and the interest rate at that time, the amount of your payment may vary each month.

If you are unsure of how much cash flow you need for a long term project that occurs in stages, a HELOC may be a better option for you.

How can I use my loan?

Now that you know a bit more about each loan, you may be asking yourself, “What’s the optimal use for a home equity loan or HELOC?”

You can use the funds for your home equity loan to pay off significant home repairs or renovations. After sitting in your home for a couple of months, while in quarantine, you’ve decided that it was time to completely renovate your kitchen. A home equity loan would be an excellent option to fund your project if you don’t have the cash readily available on hand.

Another widespread use for taking out a home equity loan is to pay off high-interest credit card debt. Since you have a home equity loan locks in a term and rate, you can trade your high-interest rates for something that fits your budget and help you pay off your debt faster.

A HELOC can be a good option for upcoming expenses like college tuition, where you don’t want to borrow money until you’re ready, and the amount you need overtime may vary.

Buyer Beware!

You’ve decided to take the plunge and know what type of loan need. But, as you look at options, beware of offers that sound too good to pass up. That fixed interest rate that is half all the others may have exorbitant fees attached to it. And the loan that lets you borrow 100% of your equity may set you up for financial trouble down the road. While the rules have tightened on predatory lending, there are still scams and other illegal options out there. If it sounds too good to be true, it probably is.

What’s Next?

After you’ve decided which home equity product is right for you, check our current rates and home equity products. With great rates like ours you’ll be able to maximize the equity in your home!

Did you like this post? Please share and sign up here to receive helpful information each month delivered right to your inbox!