Credit Score Range – Higher Score Benefits

High Score Benefits

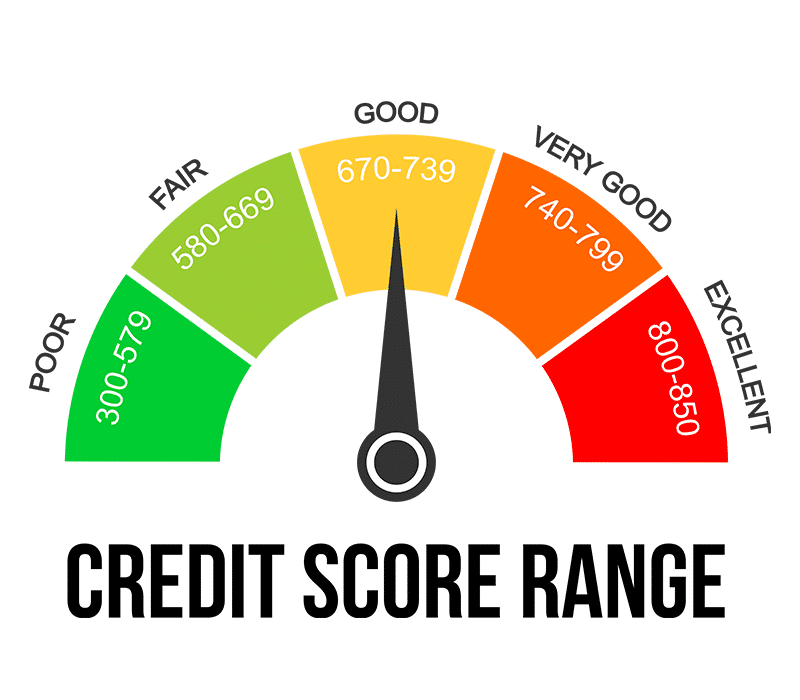

Where do you fall on the credit score range? Closely managing your credit score is important, especially since consumers are reporting access to credit is harder to achieve right now. Your credit score is one of the key factors that lenders, like credit unions, use to approve a mortgage, auto loan, and credit card. If you have a higher score, you may qualify for a higher credit limit, as well as a lower interest rate.

It’s good to periodically review where you stand on the credit score range and take steps to move it in a positive direction before significant purchases – like vacations or the holiday shopping season.

The top credit score you can earn is 850, but according to Experian, one of the three leading U.S. credit monitoring bureaus, the average U.S. FICO credit score in 2022 was 714, while the average Ohio consumer credit score was 715. The FICO score is a number that predicts how likely you are to pay back a loan on time.

The Consumer Financial Protection Bureau recommends consumers check their credit report at least once a year, and more often if applying for a new job, a line of credit or suspect they may have been a victim of financial fraud.

A few factors that can hurt your credit score include using more than 30 percent of a credit card’s line of credit (your credit card limit), closing an old account, and applying for too much credit over a short period of time.

Tips to Improve Your Credit Score

1 Check your credit report

Under federal law, consumers can obtain a free report from each of the three national credit reporting bureaus every 12 months. You can request your report at www.annualcreditreport.com. Be sure to review it thoroughly for accuracy. Collectively, the bureau reports will give you a comprehensive picture of where your credit score range is.

2 Pay bills on time

When it comes to improving your credit score, paying all your bills on time every month is crucial. It establishes a positive payment history.

3 Keep credit utilization under 30

Actively using credit cards is a good way to stay in a good credit score range, but don’t use more than 30 percent of your available credit at any given time.

4 Always pay your credit card balance in full each month

You don’t have to carry a balance and incur interest charges to build good credit. Many credit card rewards programs provide an option to apply earned rewards toward the balance. This is a great option in tighter months.

5 Leave old debts on your report

Once you finally pay off a debt, you might be tempted to eliminate it from your report, but as long as your payments are timely and complete, those debt records can keep you in a better credit score range.

6 Start using credit early

Don’t wait to start using credit. Even if you open a card and then charge and pay off a small amount each month, you’ll build a solid credit foundation.

7 Diversify your credit

Research alternative credit options such as financing a car or consolidating credit card debt with a loan. Paying off different types of credit can improve your score.

8 Connect with your local credit union

As member-owned financial institutions, credit unions often provide personalized financial guidance, offer credit-building products, and charge lower interest rates. Leveraging your local credit union resources can boost your credit score range and improve your financial well-being.

Learn how a credit union can help strengthen your financial security by visiting www.YourMoneyFurther.com

Posted In: Tips For Managing Finances