What you “auto” know about getting an auto loan

Buying a car can be exciting, fun, and scary, all at the same time. This is particularly true if money is tight and you are trying to get the best deal or if you’ve never done it before. Many buyers focus their efforts on negotiating the best purchase price with a dealer, but fail to research auto loan options as diligently, potentially throwing away hundreds of dollars in overall savings. But even though it’s a big purchase, you can also make it a pleasant purchase once you understand auto loan basics.

How does an auto loan work, anyway?

Lenders, like banks and credit unions, look at personal information such as employment, address, and credit histories, as well as info about the vehicle you want to purchase. After reviewing this information, they determine their risk and decide whether to approve the application. They set the auto loan interest rate and terms. You may or may not be required to make a down payment, depending on your credit, the vehicle, and the life of the loan. You then agree to pay back the amount borrowed over a set period of time, plus any fees and interest you accrue.

Know the auto loan lingo

To understand how auto loans work, get familiar with the following terms often used in the lending process.

· Annual percentage rate – also known as APR, this is the amount you’ll pay, as a yearly percentage, to borrow the money, including fees and interest. The higher your APR, the more you’ll pay, in total, for the loan.

· Down payment — what you pay upfront for the vehicle. This can be funds you’ve saved, the car you are trading in, or both. The more you put down, the smaller amount you need to finance – which typically means a lower monthly payment.

· Loan term – is the amount of time you have to pay off your loan. While long loan terms help spread out your payments, you pay more in interest overall.

· Monthly payment — The amount you owe, at a minimum, each month. This is a combination of your principal, interest, and other fees that may apply.

· Principal — This is the amount you are borrowing only, and does not include fees and interest.

· Total cost — is your total principal, interest, and fees you’ll pay over the life of your auto loan.

An auto loan adds to the cost of a car

With the average cost of a car hovering around $35,000, according to a Consumer Financial Protection Bureau blog post published in 2018, most people don’t have the means to buy a vehicle outright. While financing makes it is possible to purchase a car you might not be able to afford; otherwise; it’s important to keep in mind that auto loans add to the total cost because you’re paying interest and other loans fees.

Know your credit score

Shopping for a car loan would be simple, except for one thing: some people pay more for the privilege of borrowing money than others. Why? Because some people have demonstrated that they are less likely to pay it back.

This is where your credit score comes in. Your credit history details whether you’ve borrowed money in the past and if you’ve paid it back on time and in full. This history creates a number that informs lenders how risky it is to lend money to you.

Generally, people who’ve borrowed money multiple times and paid it back on time have a higher credit score than those who have late or missed payments or haven’t paid a loan back at all. Essentially, the lender must take a chance on giving you money, and the less likely they believe you are to pay your auto loan back, the more they charge to lend it to you in the first place. Knowing this is key to how auto loans work.

Before you even begin car shopping, make sure your credit score accurately reflects your actual credit history. If there are errors on your credit report (perhaps it shows you still owe money you’ve paid back), get them fixed ASAP so your score increases. You can get a full credit history report from each of the three main credit bureaus, Equifax, Experian, and TransUnion, once each year.

If you have no credit or a low score, don’t despair. Take some time to build up your score, or get a co-signer who promises to pay the loan if you can’t.

Where should I get my auto loan?

In general, auto loans are available in two ways:

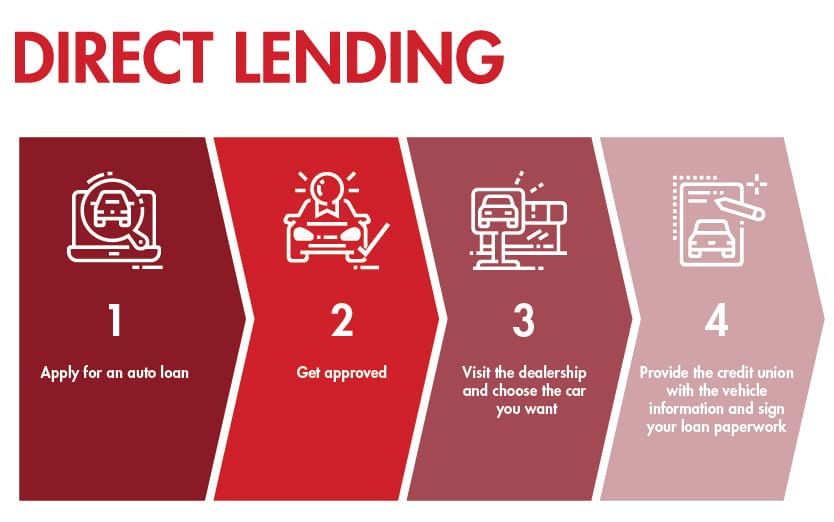

Direct lending

Direct lenders include banks, credit unions, and other financial institutions. Borrowing directly from the financial institution gives you the chance to shop around and compare rates and terms so that you can get the best auto loan for your circumstances. Typically, you’ll get preapproved (more on that in a minute) and use this loan to pay for the car.

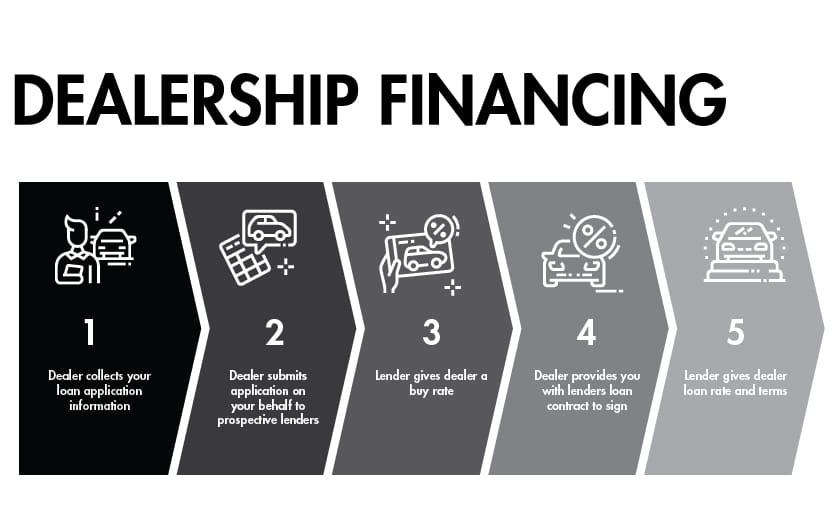

Dealership financing

Financing at a dealer allows the dealer’s finance department to request lending terms from those same types of lending partners on your behalf. This route is more convenient because you can get your loan and vehicle in the same place. However, you can’t comparison shop, so you may not get the best rates or terms. Additionally, beware of “buy here, pay here” dealers who cater to buyers who don’t have great credit in high-interest in-house auto loans.

Get Preapproved!

Ready to go car shopping? Before you hit the dealer’s lot, look around and compare auto loan rates from different lenders. You may not be aware, but interest rates for used cars are often slightly higher than those for new vehicles, even if you borrow the same amount. This is because time had proven that used car loans are typically riskier than new car loans, and as we discussed previously – the bigger the risk, the higher the interest rate.

Once you find the best auto loan option for you, apply for preapproval. Preapproval means that the lender has reviewed your credit and will give you a loan for a specified amount, term, and interest rate when deciding on the actual vehicle you will purchase.

Preapproval has a number of benefits. Once you are preapproved for an auto loan, you know how much you can afford to borrow, your interest rate, and your approximate monthly payment. Having a preapproved loan in place also gives you leverage when negotiating your price with the dealer. Preapproval also allows you to compare the financing you’ve already secured with any loan offer a dealer may extend to you.

Now that you know the terms, understand how your credit score affects interest rates, and have your preapproval, you’re ready to go pick out that new ride. Just be sure to check that it has enough cup holders!

Posted In: auto loans, Lending